The Advantage of Trading Options

1

Generate Income on your Stock/ETF Portfolio

2

Take directional views with leverage and limited risk

3

Hedge Your Portfolio with Risk-Reduction Strategies

Why Trade Options with Firstrade

Firstrade offers value investing with

$0 commissions and $0 contract fees

for options trades.

Commissions

Firstrade

TD Ameritrade

E*Trade

Charles Schwab

Fidelity

Online Stock Orders

$0

$0

$0

$0

$0

Online Option Orders

$0

$0 + $0.65/Contract

$0 + $0.65/Contract

$0 + $0.65/Contract

$0 + $0.65/Contract

Online Mutual Fund Trades

$0

$49.99

Based on prospectus

/ $0

Up to $74.95

$49.95

Broker-Assisted Stock & Options Trades

$19.95

(+$0.50/Contract)

$25

(+$0.65/Contract)

$25

(+$0.65/Contract)

$25

(+$0.65/Contract)

$32.95

(+$0.65/Contract)

Minimum Initial Deposit

$0

$0

$0

$0

$0

Pricing for competitors were obtained from their published

web sites on June 5, 2023. Some brokers may lower the fees

listed above if certain balance or activity requirements

are met. The competitor fees are believed to be accurate,

but may be subject to change. Please contact each

individual firm to confirm their latest fee schedules.

We provide you with the tools to get ahead

Innovative trading technology, analytics, education and

customer service for over 37 years.

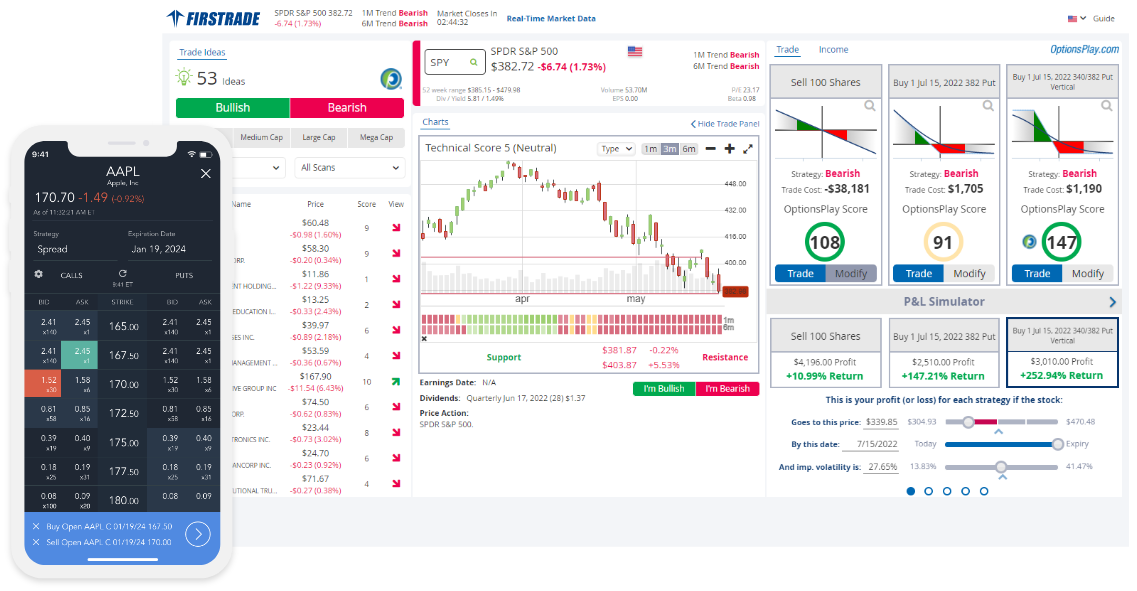

Powerful Platforms for Options Traders

Take advantage of our analytics tools to make more

precise decisions, and trade options using advanced

strategies like condor, iron condor and butterfly.

Ranked 4.5 stars by Stockbrokers.com for "Ease of

Use", our platforms offer sophisticated tools to

help investors of every level of experience manage

trading risk.

Make Smarter Trades with Rolling Options, IV and Greeks

- Use the Rolling Options feature to collect more premium or extend a trade's duration, potentially giving your stock the opportunity to further move in your favor. Rolling options are also used to collect additional premium to help lower the cost basis of a stock.

- View your potential maximum gain or loss before you place an order with the Risk/Reward Profile.

- Option Greeks measures the various factors that impact the price sensitivity of an options contract.

- Measure the different factors affecting options prices right from the options chain using Implied Volatility (IV).

Options Analysis Card

Visualize key metrics like maximum profit, break-even and maximum loss, enabling you to make confident investment decisions tailored to your unique circumstances.

The "Options Analysis" feature also serves as your strategy validator, ensuring your key order parameters – such as option types, expirations dates, strikes and transaction types – are accurate and error-free. Make data-driven adjustments to optimize your strategy and achieve your investment goals.

FREE Professional-Grade Analytics with OptionsPlay

The fully integrated OptionsPlay let's you find

opportunities and instantly execute your ideas at

Firstrade.

- Daily bullish and bearish trading ideas

- Instant options strategies based on various market outlooks

- Optimal income opportunities for any Stock or ETF

Free Options Education & Live Events

Whether you are a beginner or an advanced options trader,

Firstrade provides you with resources tools to improve

your options trading knowledge.

- Free options trading courses for beginners & experienced traders

- Full options trading video library to jump start your education

- Live trading events with professional options strategists.

Discover Top Trade Ideas

- Discover high-quality, actionable trade setups by the hour, with the Credit Spread, Covered Call & Short Put Reports.

- Get bullish and bearish trade ideas and technical analysis delivered to your inbox weekly.

Account Protection

Your account is insured by SIPC for up to $500,000.

Firstrade has been serving investors for 35 years and is a

member of FINRA and SIPC.

Extended-Hours Trading

React to market news during pre-market and

after-market-hours sessions with extended hours trading

from 8am - 8pm ET.